Cow to Consumer integration with NGRERP for the dairy industry

Great business practices. Better margins.

Over 6 billion people across the world consume milk on a regular basis. For any entity dealing with this highly perishable animal produce, the supply chain handling procurement and distribution process is of paramount importance. The quality requirement, controls, and statutory regulations governing this process also tend to be stringent. Organizations therefore need to adopt best practices to make profit in this highly competitive market space.

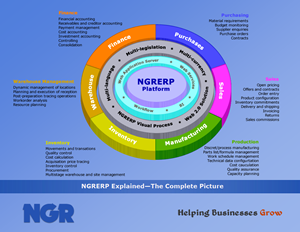

NGRERP's Cow to Consumer integration solution comprises of industry leading functionalities for Enterprise Resources Planning (ERP), Customer Relationship Management (CRM) and Supply Chain Management (SCM) on Cloud.

Enable agile milk procurement logistics

Systematic procurement. Smart distribution. Better control.

Milk Procurement is a complex process that needs to be executed swiftly on a continuous basis. NGRERP helps you to organize the procurement process.

- Formulate route-based procurement plan

- Track procurement on a real-time basis

- Track the logistics and manage the time schedule for procurement

- Make multiple purchases at the same time from multiple farmers

- Track the quality of the milk procured

- Facilitate material receipts without Purchase Orders

- Enable bulk receipts across Suppliers

- Make payments based on the quality of milk supplied (attribute-based pricing)

Regulate your milk distribution process

Plan better. Realize less wastage.

NGRERP is a sophisticated supply chain solution to distribute milk and milk products to retail outlets and also to end-customers.

- Enable stores-based sales through bulk booking

- Sell milk at specified times

- Formulate route-based procurement plan

- Pricing based on quality attributes of the product

- Efficient handling of the product shelf-life

- Provide quota-based sales to retail users and distributors

- Returning of spoilt milk

Be in control of your financials

Integrate the supply and distribute process. Get a firmer grip on your finance.

As milk and milk products are highly perishable, it is important that the supply chain (both inward and outward) is extremely responsive. NGRERP integrates the supply process and distribution of milk.

- Affords an integrated view of the financials

- Provides margins across procurements and shipments

- Enables bulk shipment across customers and dispatch routes

- Associated statutory available as part of the standard solution

- Complete stock position, along with the quality of the stock, lot-wise

- Comprehensive, attribute-based stock and pricing

Opportunities in the dairy industry

India is set to become the world's most populated country by 2030 with around 1.53 billion people and more than 19% of world’s population by the same time.

The country, housing currently approximately 18% of world population, is growing at the rate of 1.3% annually, but has only 7.3% of global arable land and faces a huge challenge ahead for its agricultural sector to feed these extra mouths.

With global populations set to rise from 7 billion today, to 8 billion by 2030 and 9 billion by 2050, opportunities for Indian food producers to respond to this growing market place are considerable. FAO (Food and Agriculture Organization of the United Nations) has analysed global dairy trends as far as 2050. Their analysis predicts that as incomes rise, people generally prefer to spend a higher share of their food budget on animal protein, so meat and dairy consumption tends to grow faster than that of food crops. As a result, the past three decades have seen buoyant growth in the consumption of livestock products, especially in newly industrialising countries and emerging markets.

Post-white revolution, the Indian dairy industry has shown constant growth in milk production as well as per capita milk availability, i.e., 51.4 million tonne in 1990 to about 127 million tonne in 2011-12 and 291 gm/day respectively. Few reports suggest that with current growth rate of approximately 3%-4%, it is thought to grow to 185 million tonne and become a $24 billion (Rs 1,44,000 crore) organised industry by 2020 and $140 billion (Rs 8,40,000 crore) including the unorganised sector. However some researchers considers the same production levels by 2022-23 itself. Even such volumes could only be attained if the system wakes up and begins to act fast on the new context being suggested by us by focussing on farmers’ groups, societies and associations rather than individuals.

Based on extrapolations of mega Indian economic story and analysis of domestic growth, India will shoot ahead of Japan in mid 2030s to become the world’s third biggest economy. Consequently a huge surge in GDP (gross domestic product) and PPP (public-private partnership) is expected, reflecting in enhanced protein consumption in the form of dairy products in India. During the next few years, till 2030, the demand for dairy products is expected to grow at a rate of 9%-12% and industry at a rate of 4-5%. Clearly, the Indian industry will struggle to maintain 100% self-sufficiency due to huge local demand, between 160 to 170 million tonne of milk that would be required by 2030. The industry will have to overhaul to meet ends. With the potential to accommodate imports with home produced dairy products, the Indian industry will present to be a very lucrative market.

From 2009 to 2014, the middle class in Africa grew by three times from 120 to 330 million and by six times from 500 million to 3.2 billion. This trend is yet to bloom fully and this booming economy and expanding cash-rich middle-class, would mean a lucrative and very incentivising market. This would make India a hotspot of globally competitive and compliant dairy destination.

The dairy industry would witness further consolidation of organised dairy structure to an impressive 35% by that time. Post-2020’s industry will see increased dominance and importance of “A” class global brands and emergence of “private labels” meaning Indian dairy industry would be under pressure to become globally competitive at all stages of the supply chain.

Customer maturity along with FSSAI (Food Safety and Standards Authority of India) norms and adaptations of newer versions of food quality norms like FSMA (FDA - Food Safety Modernisation Act) would coerce the industry to improve efficiency and effectiveness and where possible, benchmark their performance.